01 December 2014

Article from Reefer Trends WEEK 48, 2014 – ISSUE 728

Reefer RoRo reflections:

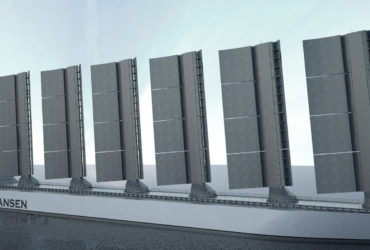

The official Press Release heralding the mk II design states that the ship is, ‘intended for worldwide operation as a Reefer RoRo in the banana trade with special emphasis on a very low box rate, by very fast and efficient cargo handling in port which enables slow steaming.’ Reefer Trends understands that it has been re-designed specifically with the Central America to EU banana and pineapple trades in mind.

If this is the case, then with a capacity of 12,500 pallets to render the vessel fuel-efficient, at first glance there are only arguably three charterers capable of optimizing the use of the available capacity. Given that the only Central American country to supply the EU with any great volume of bananas and pineapples is Costa Rica, Del Monte would be one of the three because it has the critical mass. The other two are reefer operators Seatrade and Cool Carriers, both of whom run transatlantic liner services from the region.

But there are problems associated with all three: in virtue of its decision to sub-contract its fruit on a third party liner service for 2015, Del Monte appears to be moving away from its long-held supply chain model for shipments to Europe. Last year Del Monte also switched its West Africa to UK and N Cont fruit away from the AEL reefer service and into containers.

While Seatrade and Cool would also likely be interested, not least because of their extensive backhaul cargo connections, they would both presumably want to wait to see what impact the new US$1bn APM Terminals container terminal in Moin is going to have on reefer logistics and cargo market share in Costa Rica and perhaps an enlarged Panama Canal before considering an investment decision. It also remains to be seen whether Seatrade’s recent flirtation with the dark side morphs into a fully consummated relationship…

There are other transatlantic banana services, none of which independently has the critical mass of product required by the Reefer RoRo. However this would not preclude the majors from slot or space-sharing a service, as is anyway happening today. If a second loading port could be added without compromising the integrity of the service, this would bring Dole, Fyffes and Chiquita into play. To make the Reefer RoRo work from Colombia, the vessels would need to load containerized bananas from logistically challenged Turbo, while any service from Ecuador would require at least five vessels, and more with Ice Class if St Petersburg is the final destination. There is also the issue of port side logistics – how many terminals at either end of the chain could accommodate such an operation?

However if the claims made by the three stakeholders in the vessel are upheld/legitimate, the Reefer RoRo offers a better (faster, dedicated, direct) service at a lower cost than the carriers. In other words it solves the cost/service conundrum. In terms of cost, Maersk Line is reported to be loading for Fyffes at a rate of about US$3.95 per box, Terminal Handling Charge (THC) included. Meanwhile the contract recently concluded between Hamburg Süd and Del Monte is worth a reported US$3.45 per box including THC, with the carrier also committing to pay for a barge service from Turbo to Cartagena! If the rates quoted are accurate, neither of these services is sustainable in the medium to long term. Possibly neither in the short term. At the moment both carriers are over-tonnaged and both would prefer some contribution to loss-making strings to the alternative of laying up.

According to patent holder Birger Lindberg Skov, the Reefer RoRo Ship has a banana box rate cost of US$2.50, full liner terms equivalent. “The rate is calculated on a full load of bananas and 80% utilization of cars, trucks etc. on the back haul. “If the ship is only 50% full on the back haul, the rate increases to only US$2.70 per box. “Neither the container lines nor the specialised reefers can compete sustainably with that rate,” he said to Reefer Trends. If a banana major were to switch to four Reefer RoRo ships, Mr Lindberg Skov calculates that it would save at least US$25m per year!

Without access to the calculations it is difficult to treat Mr Lindberg Skov’s assumptions on cost on anything other than face value. The model clearly depends on a significant contribution from backhaul business, which is more difficult to verify independently than the core fruit shipments that form the head haul.

“If the banana majors and the operators want to control their supply chains they need a new type of reefer ship, or they will be in the pockets of the container lines when there is no other alternative,” Mr Skov added. “You have written about this scenario in Reefer Trends many times. “At least the Reefer RoRo gives them a viable alternative. “It the majors can co-sail with the conventional operators and container lines, why not with the Reefer RoRo?”

Why not indeed? It would be a shame if the only factor preventing a paradigm shift to a new supply chain model is a conservative mindset. The banana majors are under pressure from their retail customers as never before, either on pricing or the not unrealistic threat that they will ultimately be by-passed. On the other hand, in their favour they have varying degrees of control over production. But this too can change: retailers tend to think along similar time horizons as the container lines…

So, how long the status quo can be maintained remains to be seen. In the meantime any charterer or cargo interest that abdicates control or management of its supply chain loses a large part, and in some cases, all of its competitive advantage. Critically, if the majors decline the option of a space share on a dedicated reefer, they will find themselves slot-sharing on a third party liner service over which they have no control. And then what difference is there between a branded and a non-branded banana?

Without wishing to appear patronizing, it just needs a little imagination to understand the difference between ‘my supply chain’ and ‘the supply chain’ when analyzing strategic competitive advantage. The battleground has changed: the first fight the banana majors face is with their customers, not each other. Once this cost battle is won, they can focus on developing brand value.

No matter how hard the carriers try to change perceptions, a container service for reefers is and always will be little more than a box and a price – and while the prices on offer today may be low enough to buy business away from the reefer, no-one can surely be under any illusion that this will not change once any semblance of competition disappears, not least because the principal carriers have quite openly stated that their current Return On Investment on reefer is inadequate.

One final thought: if the container lines are genuinely interested in reefer as an end in itself rather than simply a means of increasing revenue by diversification, the Reefer RoRo would surely be a justifiable investment…?

Download the article

Related Pages

Tender Design of RoRo Reefer

- Vessel type: Special purpose vessel

- Vessel name: RoRo Reefer

- Project number: 13020.01

RoRo Reefer/Trailer Vessel

- Vessel type: Special purpose vessel

- Vessel name: RoRo Reefer/Trailer Vessel

- Project number: 13020.02